45. Optimal Taxation with State-Contingent Debt#

In addition to what’s in Anaconda, this lecture will need the following libraries:

!pip install --upgrade quantecon

45.1. Overview#

This lecture describes a celebrated model of optimal fiscal policy by Robert E. Lucas, Jr., and Nancy Stokey [Lucas and Stokey, 1983].

The model revisits classic issues about how to pay for a war.

Here a war means a more or less temporary surge in an exogenous government expenditure process.

The model features

a government that must finance an exogenous stream of government expenditures with either

a flat rate tax on labor, or

purchases and sales from a full array of Arrow state-contingent securities

a representative household that values consumption and leisure

a linear production function mapping labor into a single good

a Ramsey planner who at time

After first presenting the model in a space of sequences, we shall represent it recursively in terms of two Bellman equations formulated along lines that we encountered in Dynamic Stackelberg models.

As in Dynamic Stackelberg models, to apply dynamic programming we shall define the state vector artfully.

In particular, we shall include forward-looking variables that summarize optimal responses of private agents to a Ramsey plan.

See Optimal taxation for analysis within a linear-quadratic setting.

Let’s start with some standard imports:

import numpy as np

import matplotlib.pyplot as plt

from scipy.optimize import root

from quantecon import MarkovChain

from quantecon.optimize.nelder_mead import nelder_mead

from numba import njit, prange, float64

from numba.experimental import jitclass

45.2. A Competitive Equilibrium with Distorting Taxes#

At time

For

We begin by assuming that government purchases

Let

A representative household is endowed with one unit of time that can be divided

between leisure

Output equals

A representative household’s preferences over

where the utility function

The technology pins down a pre-tax wage rate to unity for all

The government imposes a flat-rate tax

There are complete markets in one-period Arrow securities.

One unit of an Arrow security issued at time

The government issues one-period Arrow securities each period.

The government has a sequence of budget constraints whose time

where

Government debt

The representative household has a sequence of budget constraints whose time

A government policy is an exogenous sequence

A feasible allocation is a consumption-labor supply plan

A price system is a sequence of Arrow security prices

The household faces the price system as a price-taker and takes the government policy as given.

The household chooses

A competitive equilibrium with distorting taxes is a feasible allocation, a price system, and a government policy such that

Given the price system and the government policy, the allocation solves the household’s optimization problem.

Given the allocation, government policy, and price system, the government’s budget constraint is satisfied for all

Note

There are many competitive equilibria with distorting taxes.

They are indexed by different government policies.

The Ramsey problem or optimal taxation problem is to choose a competitive equilibrium with distorting taxes that maximizes (45.3).

45.2.1. Arrow-Debreu Version of Price System#

We find it convenient sometimes to work with the Arrow-Debreu price system that is implied by a sequence of Arrow securities prices.

Let

The following recursion relates Arrow-Debreu prices

Arrow-Debreu prices are useful when we want to compress a sequence of budget constraints into a single intertemporal budget constraint, as we shall find it convenient to do below.

45.2.2. Primal Approach#

We apply a popular approach to solving a Ramsey problem, called the primal approach.

The idea is to use first-order conditions for household optimization to eliminate taxes and prices in favor of quantities, then pose an optimization problem cast entirely in terms of quantities.

After Ramsey quantities have been found, taxes and prices can then be unwound from the allocation.

The primal approach uses four steps:

Obtain first-order conditions of the household’s problem and solve them for

Substitute these expressions for taxes and prices in terms of the allocation into the household’s present-value budget constraint.

This intertemporal constraint involves only the allocation and is regarded as an implementability constraint.

Find the allocation that maximizes the utility of the representative household (45.3) subject to the feasibility constraints (45.1) and (45.2) and the implementability condition derived in step 2.

This optimal allocation is called the Ramsey allocation.

Use the Ramsey allocation together with the formulas from step 1 to find taxes and prices.

45.2.3. The Implementability Constraint#

By sequential substitution of one one-period budget constraint (45.5) into another, we can obtain the household’s present-value budget constraint:

To approach the Ramsey problem, we study the household’s optimization problem.

First-order conditions for the household’s problem for

and

where

Equation (45.9) implies that the Arrow-Debreu price system satisfies

(The stochastic process

Using the first-order conditions (45.8) and (45.9) to eliminate taxes and prices from (45.7), we derive the implementability condition

The Ramsey problem is to choose a feasible allocation that maximizes

subject to (45.11).

45.2.4. Solution Details#

First, define a “pseudo utility function”

where

Next form the Lagrangian

where

Given an initial government debt

The first-order conditions for the Ramsey problem for periods

and

Please note how these first-order conditions differ between

It is instructive to use first-order conditions (45.15) for

For convenience, we suppress the time subscript and the index

where we have imposed conditions (45.1) and (45.2).

Equation (45.17) is one equation that can be solved to express the

unknown

We also know that time

Notice that a counterpart to

But things are different for time

An analogous argument for the

These outcomes mean that the following statement would be true even when

government purchases are history-dependent functions

Proposition:

If government purchases are equal after two histories

then it follows from (45.17) that the Ramsey choices of consumption and leisure,

The proposition asserts that the optimal allocation is a function of the

currently realized quantity of government purchases

45.2.5. The Ramsey Allocation for a Given Multiplier#

Temporarily take

We shall compute

Evidently, for

But for

Thus, while

The absence of

Of course,

45.2.6. Further Specialization#

At this point, it is useful to specialize the model in the following ways.

We assume that

Also, assume that government purchases

We maintain these assumptions throughout the remainder of this lecture.

45.2.7. Determining the Lagrange Multiplier#

We complete the Ramsey plan by computing the Lagrange multiplier

Government budget balance restricts

The household’s first-order conditions imply

and the implied one-period Arrow securities prices

Substituting from (45.19), (45.20), and the feasibility condition (45.2) into the recursive version (45.5) of the household budget constraint gives

Define

Notice that

Hence the equation shares much of the structure of a simple asset pricing equation with

We learned earlier that for a Ramsey allocation

That means that we can express equation (45.21) as

where

Given

If we let

This is a system of

In these equations, by

After solving for

where division here means an element-by-element division of the respective

components of the

Here is a computational algorithm:

Start with a guess for the value for

these are

Solve the

these depend on

Find a

by gradually raising

After computing a Ramsey allocation, recover the flat tax rate on labor from (45.8) and the implied one-period Arrow securities prices from (45.9).

In summary, when

45.2.8. Time Inconsistency#

Let

Then

A time

A time

The means that a Ramsey plan is not time consistent.

Another way to say the same thing is that a Ramsey plan is time inconsistent.

The reason is that a continuation Ramsey plan takes

We shall discuss this more below.

45.2.9. Specification with CRRA Utility#

In our calculations below and in a subsequent lecture based on an extension of the Lucas-Stokey model by Aiyagari, Marcet, Sargent, and Seppälä (2002) [Aiyagari et al., 2002], we shall modify the one-period utility function assumed above.

(We adopted the preceding utility specification because it was the one used in the original Lucas-Stokey paper [Lucas and Stokey, 1983]. We shall soon revert to that specification in a subsequent section.)

We will modify their specification by instead assuming that the representative agent has utility function

where

We continue to assume that

We eliminate leisure from the model.

We also eliminate Lucas and Stokey’s restriction that

We replace these two things with the assumption that

labor

With these adjustments, the analysis of Lucas and Stokey prevails once we make the following replacements

With these understandings, equations (45.17) and (45.18) simplify in the case of the CRRA utility function.

They become

and

In equation (45.27), it is understood that

In addition, the time

where

In equation (45.29), it is understood that

45.2.10. Sequence Implementation#

The above steps are implemented in a class called SequentialLS

class SequentialLS:

'''

Class that takes a preference object, state transition matrix,

and state contingent government expenditure plan as inputs, and

solves the sequential allocation problem described above.

It returns optimal allocations about consumption and labor supply,

as well as the multiplier on the implementability constraint Φ.

'''

def __init__(self,

pref,

π=np.full((2, 2), 0.5),

g=np.array([0.1, 0.2])):

# Initialize from pref object attributes

self.β, self.π, self.g = pref.β, π, g

self.mc = MarkovChain(self.π)

self.S = len(π) # Number of states

self.pref = pref

# Find the first best allocation

self.find_first_best()

def FOC_first_best(self, c, g):

'''

First order conditions that characterize

the first best allocation.

'''

pref = self.pref

Uc, Ul = pref.Uc, pref.Ul

n = c + g

l = 1 - n

return Uc(c, l) - Ul(c, l)

def find_first_best(self):

'''

Find the first best allocation

'''

S, g = self.S, self.g

res = root(self.FOC_first_best, np.full(S, 0.5), args=(g,))

if (res.fun > 1e-10).any():

raise Exception('Could not find first best')

self.cFB = res.x

self.nFB = self.cFB + g

def FOC_time1(self, c, Φ, g):

'''

First order conditions that characterize

optimal time 1 allocation problems.

'''

pref = self.pref

Uc, Ucc, Ul, Ull, Ulc = pref.Uc, pref.Ucc, pref.Ul, pref.Ull, pref.Ulc

n = c + g

l = 1 - n

LHS = (1 + Φ) * Uc(c, l) + Φ * (c * Ucc(c, l) - n * Ulc(c, l))

RHS = (1 + Φ) * Ul(c, l) + Φ * (c * Ulc(c, l) - n * Ull(c, l))

diff = LHS - RHS

return diff

def time1_allocation(self, Φ):

'''

Computes optimal allocation for time t >= 1 for a given Φ

'''

pref = self.pref

S, g = self.S, self.g

# use the first best allocation as intial guess

res = root(self.FOC_time1, self.cFB, args=(Φ, g))

if (res.fun > 1e-10).any():

raise Exception('Could not find LS allocation.')

c = res.x

n = c + g

l = 1 - n

# Compute x

I = pref.Uc(c, n) * c - pref.Ul(c, l) * n

x = np.linalg.solve(np.eye(S) - self.β * self.π, I)

return c, n, x

def FOC_time0(self, c0, Φ, g0, b0):

'''

First order conditions that characterize

time 0 allocation problem.

'''

pref = self.pref

Ucc, Ulc = pref.Ucc, pref.Ulc

n0 = c0 + g0

l0 = 1 - n0

diff = self.FOC_time1(c0, Φ, g0)

diff -= Φ * (Ucc(c0, l0) - Ulc(c0, l0)) * b0

return diff

def implementability(self, Φ, b0, s0, cn0_arr):

'''

Compute the differences between the RHS and LHS

of the implementability constraint given Φ,

initial debt, and initial state.

'''

pref, π, g, β = self.pref, self.π, self.g, self.β

Uc, Ul = pref.Uc, pref.Ul

g0 = self.g[s0]

c, n, x = self.time1_allocation(Φ)

res = root(self.FOC_time0, cn0_arr[0], args=(Φ, g0, b0))

c0 = res.x

n0 = c0 + g0

l0 = 1 - n0

cn0_arr[:] = c0.item(), n0.item()

LHS = Uc(c0, l0) * b0

RHS = Uc(c0, l0) * c0 - Ul(c0, l0) * n0 + β * π[s0] @ x

return RHS - LHS

def time0_allocation(self, b0, s0):

'''

Finds the optimal time 0 allocation given

initial government debt b0 and state s0

'''

# use the first best allocation as initial guess

cn0_arr = np.array([self.cFB[s0], self.nFB[s0]])

res = root(self.implementability, 0., args=(b0, s0, cn0_arr))

if (res.fun > 1e-10).any():

raise Exception('Could not find time 0 LS allocation.')

Φ = res.x[0]

c0, n0 = cn0_arr

return Φ, c0, n0

def τ(self, c, n):

'''

Computes τ given c, n

'''

pref = self.pref

Uc, Ul = pref.Uc, pref.Ul

return 1 - Ul(c, 1-n) / Uc(c, 1-n)

def simulate(self, b0, s0, T, sHist=None):

'''

Simulates planners policies for T periods

'''

pref, π, β = self.pref, self.π, self.β

Uc = pref.Uc

if sHist is None:

sHist = self.mc.simulate(T, s0)

cHist, nHist, Bhist, τHist, ΦHist = np.empty((5, T))

RHist = np.empty(T-1)

# Time 0

Φ, cHist[0], nHist[0] = self.time0_allocation(b0, s0)

τHist[0] = self.τ(cHist[0], nHist[0])

Bhist[0] = b0

ΦHist[0] = Φ

# Time 1 onward

for t in range(1, T):

c, n, x = self.time1_allocation(Φ)

τ = self.τ(c, n)

u_c = Uc(c, 1-n)

s = sHist[t]

Eu_c = π[sHist[t-1]] @ u_c

cHist[t], nHist[t], Bhist[t], τHist[t] = c[s], n[s], x[s] / u_c[s], τ[s]

RHist[t-1] = Uc(cHist[t-1], 1-nHist[t-1]) / (β * Eu_c)

ΦHist[t] = Φ

gHist = self.g[sHist]

yHist = nHist

return [cHist, nHist, Bhist, τHist, gHist, yHist, sHist, ΦHist, RHist]

45.3. Recursive Formulation of the Ramsey Problem#

We now temporarily revert to Lucas and Stokey’s specification.

We start by noting that

But backward-looking.

45.3.1. Intertemporal Delegation#

To express a Ramsey plan recursively, we imagine that a time

A “continuation Ramsey planner” at time

A key step in representing a Ramsey plan recursively is

to regard the marginal utility scaled government debts

Continuation Ramsey planners do this by choosing continuation policies that induce the representative

household to make choices that imply that

A time

A time

While a time

Furthermore, the Ramsey planner cares about

The time

These lines of delegated authorities and

responsibilities across time express the continuation Ramsey planners’

obligations to implement their parts of an original Ramsey plan that had been

designed once-and-for-all at time

45.3.2. Two Bellman Equations#

After

Let

Let

We work backward by preparing a Bellman equation for

45.3.3. The Continuation Ramsey Problem#

The Bellman equation for a time

where maximization over

Here

For each given value of

Associated with a value function

45.3.4. The Ramsey Problem#

The Bellman equation of the time

where maximization over

coming from restriction (45.26).

Associated with a value function

Notice the appearance of state variables

The value function

45.3.5. First-Order Conditions#

Attach a Lagrange multiplier

Time

for

for

Given

Equation (45.36) implies

Time

for

Notice similarities and differences between the first-order

conditions for

An additional term is present in (45.40) except in three special cases

initial government assets are sufficiently large to finance all government purchases with interest earnings from those assets so that

Except in these special cases, the allocation and the labor tax rate as

functions of

Naturally, the first-order conditions in this recursive formulation of the Ramsey problem agree with the first-order conditions derived when we first formulated the Ramsey plan in the space of sequences.

45.3.6. State Variable Degeneracy#

Equations (45.38) and (45.39) imply that

for all

When

Given

45.3.7. Manifestations of Time Inconsistency#

While the marginal utility adjusted level of government debt

The time

The discrepancy in state variables faced by the time

The time

The time

In contrast, time

When government expenditures

This means that

This in turn means that prices of

one-period Arrow securities

The differences between these

time

45.3.8. Recursive Implementation#

The above steps are implemented in a class called RecursiveLS.

class RecursiveLS:

'''

Compute the planner's allocation by solving Bellman

equation.

'''

def __init__(self,

pref,

x_grid,

π=np.full((2, 2), 0.5),

g=np.array([0.1, 0.2])):

self.π, self.g, self.S = π, g, len(π)

self.pref, self.x_grid = pref, x_grid

bounds = np.empty((self.S, 2))

# bound for n

bounds[0] = 0, 1

# bound for xprime

for s in range(self.S-1):

bounds[s+1] = x_grid.min(), x_grid.max()

self.bounds = bounds

# initialization of time 1 value function

self.V = None

def time1_allocation(self, V=None, tol=1e-7):

'''

Solve the optimal time 1 allocation problem

by iterating Bellman value function.

'''

π, g, S = self.π, self.g, self.S

pref, x_grid, bounds = self.pref, self.x_grid, self.bounds

# initial guess of value function

if V is None:

V = np.zeros((len(x_grid), S))

# initial guess of policy

z = np.empty((len(x_grid), S, S+2))

# guess of n

z[:, :, 1] = 0.5

# guess of xprime

for s in range(S):

for i in range(S-1):

z[:, s, i+2] = x_grid

while True:

# value function iteration

V_new, z_new = T(V, z, pref, π, g, x_grid, bounds)

if np.max(np.abs(V - V_new)) < tol:

break

V = V_new

z = z_new

self.V = V_new

self.z1 = z_new

self.c1 = z_new[:, :, 0]

self.n1 = z_new[:, :, 1]

self.xprime1 = z_new[:, :, 2:]

return V_new, z_new

def time0_allocation(self, b0, s0):

'''

Find the optimal time 0 allocation by maximization.

'''

if self.V is None:

self.time1_allocation()

π, g, S = self.π, self.g, self.S

pref, x_grid, bounds = self.pref, self.x_grid, self.bounds

V, z1 = self.V, self.z1

x = 1. # x is arbitrary

res = nelder_mead(obj_V,

z1[0, s0, 1:-1],

args=(x, s0, V, pref, π, g, x_grid, b0),

bounds=bounds,

tol_f=1e-10)

n0, xprime0 = IC(res.x, x, s0, b0, pref, π, g)

c0 = n0 - g[s0]

z0 = np.array([c0, n0, *xprime0])

self.z0 = z0

self.n0 = n0

self.c0 = n0 - g[s0]

self.xprime0 = xprime0

return z0

def τ(self, c, n):

'''

Computes τ given c, n

'''

pref = self.pref

uc, ul = pref.Uc(c, 1-n), pref.Ul(c, 1-n)

return 1 - ul / uc

def simulate(self, b0, s0, T, sHist=None):

'''

Simulates Ramsey plan for T periods

'''

pref, π = self.pref, self.π

Uc = pref.Uc

if sHist is None:

sHist = self.mc.simulate(T, s0)

cHist, nHist, Bhist, τHist, xHist = np.empty((5, T))

RHist = np.zeros(T-1)

# Time 0

self.time0_allocation(b0, s0)

cHist[0], nHist[0], xHist[0] = self.c0, self.n0, self.xprime0[s0]

τHist[0] = self.τ(cHist[0], nHist[0])

Bhist[0] = b0

# Time 1 onward

for t in range(1, T):

s, x = sHist[t], xHist[t-1]

cHist[t] = np.interp(x, self.x_grid, self.c1[:, s])

nHist[t] = np.interp(x, self.x_grid, self.n1[:, s])

τHist[t] = self.τ(cHist[t], nHist[t])

Bhist[t] = x / Uc(cHist[t], 1-nHist[t])

c, n = np.empty((2, self.S))

for sprime in range(self.S):

c[sprime] = np.interp(x, x_grid, self.c1[:, sprime])

n[sprime] = np.interp(x, x_grid, self.n1[:, sprime])

Euc = π[sHist[t-1]] @ Uc(c, 1-n)

RHist[t-1] = Uc(cHist[t-1], 1-nHist[t-1]) / (self.pref.β * Euc)

gHist = self.g[sHist]

yHist = nHist

if t < T-1:

sprime = sHist[t+1]

xHist[t] = np.interp(x, self.x_grid, self.xprime1[:, s, sprime])

return [cHist, nHist, Bhist, τHist, gHist, yHist, xHist, RHist]

# Helper functions

@njit(parallel=True)

def T(V, z, pref, π, g, x_grid, bounds):

'''

One step iteration of Bellman value function.

'''

S = len(π)

V_new = np.empty_like(V)

z_new = np.empty_like(z)

for i in prange(len(x_grid)):

x = x_grid[i]

for s in prange(S):

res = nelder_mead(obj_V,

z[i, s, 1:-1],

args=(x, s, V, pref, π, g, x_grid),

bounds=bounds,

tol_f=1e-10)

# optimal policy

n, xprime = IC(res.x, x, s, None, pref, π, g)

z_new[i, s, 0] = n - g[s] # c

z_new[i, s, 1] = n # n

z_new[i, s, 2:] = xprime # xprime

V_new[i, s] = res.fun

return V_new, z_new

@njit

def obj_V(z_sub, x, s, V, pref, π, g, x_grid, b0=None):

'''

The objective on the right hand side of the Bellman equation.

z_sub contains guesses of n and xprime[:-1].

'''

S = len(π)

β, U = pref.β, pref.U

# find (n, xprime) that satisfies implementability constraint

n, xprime = IC(z_sub, x, s, b0, pref, π, g)

c, l = n-g[s], 1-n

# if xprime[-1] violates bound, return large penalty

if (xprime[-1] < x_grid.min()):

return -1e9 * (1 + np.abs(xprime[-1] - x_grid.min()))

elif (xprime[-1] > x_grid.max()):

return -1e9 * (1 + np.abs(xprime[-1] - x_grid.max()))

# prepare Vprime vector

Vprime = np.empty(S)

for sprime in range(S):

Vprime[sprime] = np.interp(xprime[sprime], x_grid, V[:, sprime])

# compute the objective value

obj = U(c, l) + β * π[s] @ Vprime

return obj

@njit

def IC(z_sub, x, s, b0, pref, π, g):

'''

Find xprime[-1] that satisfies the implementability condition

given the guesses of n and xprime[:-1].

'''

β, Uc, Ul = pref.β, pref.Uc, pref.Ul

n = z_sub[0]

xprime = np.empty(len(π))

xprime[:-1] = z_sub[1:]

c, l = n-g[s], 1-n

uc = Uc(c, l)

ul = Ul(c, l)

if b0 is None:

diff = x

else:

diff = uc * b0

diff -= uc * (n - g[s]) - ul * n + β * π[s][:-1] @ xprime[:-1]

xprime[-1] = diff / (β * π[s][-1])

return n, xprime

45.4. Examples#

We return to the setup with CRRA preferences described above.

45.4.1. Anticipated One-Period War#

This example illustrates in a simple setting how a Ramsey planner manages risk.

Government expenditures are known for sure in all periods except one

For

At

If there is war,

If there is no war

We define the components of the state vector as the following six

We think of these 6 states as corresponding to

The transition matrix is

Government expenditures at each state are

We assume that the representative agent has utility function

and set

Note

For convenience in terms of matching our code, we have expressed

utility as a function of

This utility function is implemented in the class CRRAutility.

crra_util_data = [

('β', float64),

('σ', float64),

('γ', float64)

]

@jitclass(crra_util_data)

class CRRAutility:

def __init__(self,

β=0.9,

σ=2,

γ=2):

self.β, self.σ, self.γ = β, σ, γ

# Utility function

def U(self, c, l):

# Note: `l` should not be interpreted as labor, it is an auxiliary

# variable used to conveniently match the code and the equations

# in the lecture

σ = self.σ

if σ == 1.:

U = np.log(c)

else:

U = (c**(1 - σ) - 1) / (1 - σ)

return U - (1-l) ** (1 + self.γ) / (1 + self.γ)

# Derivatives of utility function

def Uc(self, c, l):

return c ** (-self.σ)

def Ucc(self, c, l):

return -self.σ * c ** (-self.σ - 1)

def Ul(self, c, l):

return (1-l) ** self.γ

def Ull(self, c, l):

return -self.γ * (1-l) ** (self.γ - 1)

def Ucl(self, c, l):

return 0

def Ulc(self, c, l):

return 0

We set initial government debt

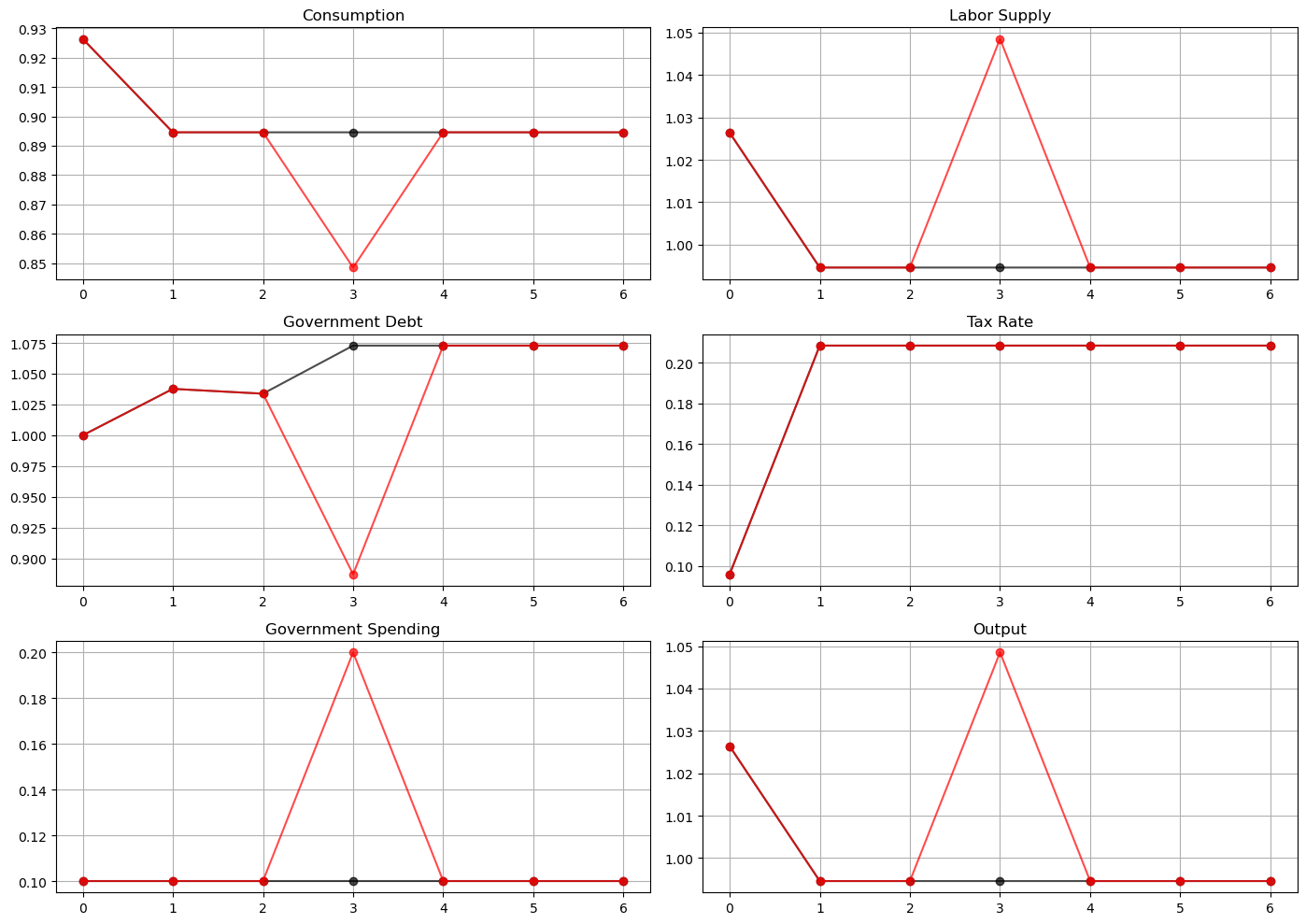

We can now plot the Ramsey tax under both realizations of time

black when

red when

π = np.array([[0, 1, 0, 0, 0, 0],

[0, 0, 1, 0, 0, 0],

[0, 0, 0, 0.5, 0.5, 0],

[0, 0, 0, 0, 0, 1],

[0, 0, 0, 0, 0, 1],

[0, 0, 0, 0, 0, 1]])

g = np.array([0.1, 0.1, 0.1, 0.2, 0.1, 0.1])

crra_pref = CRRAutility()

# Solve sequential problem

seq = SequentialLS(crra_pref, π=π, g=g)

sHist_h = np.array([0, 1, 2, 3, 5, 5, 5])

sHist_l = np.array([0, 1, 2, 4, 5, 5, 5])

sim_seq_h = seq.simulate(1, 0, 7, sHist_h)

sim_seq_l = seq.simulate(1, 0, 7, sHist_l)

fig, axes = plt.subplots(3, 2, figsize=(14, 10))

titles = ['Consumption', 'Labor Supply', 'Government Debt',

'Tax Rate', 'Government Spending', 'Output']

for ax, title, sim_l, sim_h in zip(axes.flatten(),

titles,

sim_seq_l[:6],

sim_seq_h[:6]):

ax.set(title=title)

ax.plot(sim_l, '-ok', sim_h, '-or', alpha=0.7)

ax.grid()

plt.tight_layout()

plt.show()

Tax smoothing

the tax rate is constant for all

For

For

Under other one-period utility functions, the time

the tax rate is the same at

We have assumed that at

It sets the time

It does this by increasing consumption at time

This has the consequence of lowering the time

A tax policy that makes time

Lowering the time

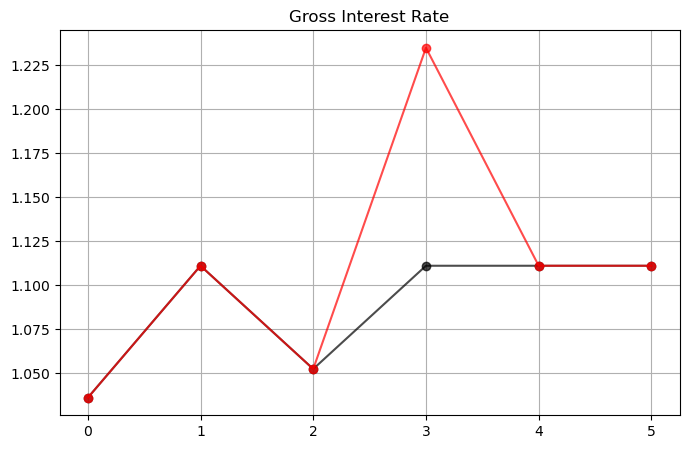

We see this in a figure below that plots the time path for the risk-free interest

rate under both realizations of the time

The following plot illustrates how the government lowers the interest rate at time 0 by raising consumption

fix, ax = plt.subplots(figsize=(8, 5))

ax.set_title('Gross Interest Rate')

ax.plot(sim_seq_l[-1], '-ok', sim_seq_h[-1], '-or', alpha=0.7)

ax.grid()

plt.show()

45.4.2. Government Saving#

At time

This is a consequence of it setting a lower tax rate at

At time

Its motive for doing this is that it anticipates a likely war at

At time

It purchases a security that pays off when

It sells a security that pays off when

These purchases are designed in such a way that regardless of whether or not there is a war at

The time

At times

45.4.3. Time 0 Manipulation of Interest Rate#

We have seen that when

By lowering this interest rate, the plan makes time

By doing this, it lowers the value of time

45.4.4. Time 0 and Time-Inconsistency#

In the preceding example, the Ramsey tax rate at time 0 differs from its value at time 1.

To explore what is going on here, let’s simplify things by removing the possibility of war at time

The Ramsey problem then includes no randomness because

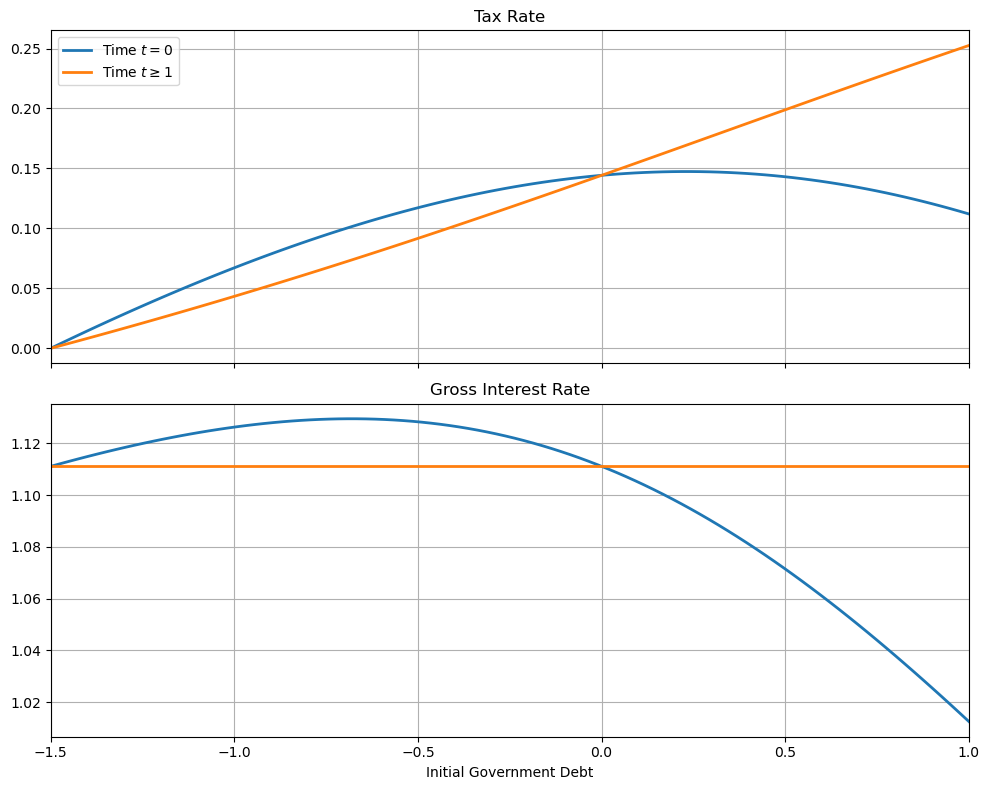

The figure below plots the Ramsey tax rates and gross interest rates at time

tax_seq = SequentialLS(CRRAutility(), g=np.array([0.15]), π=np.ones((1, 1)))

n = 100

tax_policy = np.empty((n, 2))

interest_rate = np.empty((n, 2))

gov_debt = np.linspace(-1.5, 1, n)

for i in range(n):

tax_policy[i] = tax_seq.simulate(gov_debt[i], 0, 2)[3]

interest_rate[i] = tax_seq.simulate(gov_debt[i], 0, 3)[-1]

fig, axes = plt.subplots(2, 1, figsize=(10,8), sharex=True)

titles = ['Tax Rate', 'Gross Interest Rate']

for ax, title, plot in zip(axes, titles, [tax_policy, interest_rate]):

ax.plot(gov_debt, plot[:, 0], gov_debt, plot[:, 1], lw=2)

ax.set(title=title, xlim=(min(gov_debt), max(gov_debt)))

ax.grid()

axes[0].legend(('Time $t=0$', r'Time $t \geq 1$'))

axes[1].set_xlabel('Initial Government Debt')

fig.tight_layout()

plt.show()

The figure indicates that if the government enters with positive debt, it sets

a tax rate at

By setting a lower tax rate at

It does this by increasing

Conversely, if

A side effect of lowering time

There are only two values of initial government debt at which the tax rate is

constant for all

The first is

Here the government can’t use the

The second occurs when the government enters with sufficiently large assets

that the Ramsey planner can achieve first best and sets

It is only for these two values of initial government debt that the Ramsey plan is time-consistent.

Another way of saying this is that, except for these two values of initial government debt, a continuation of a Ramsey plan is not a Ramsey plan.

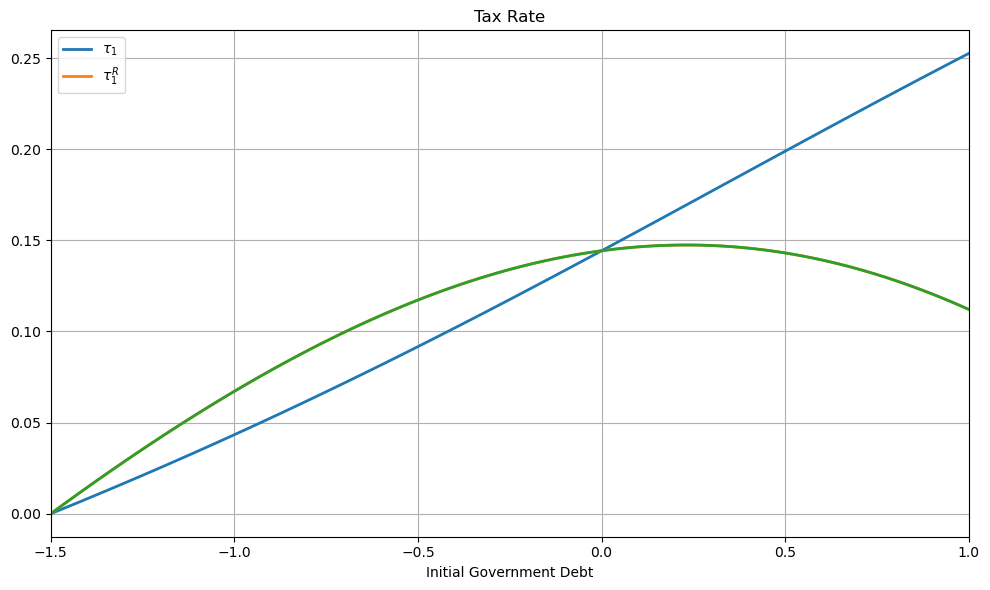

To illustrate this, consider a Ramsey planner who starts with an initial

government debt

Call

The figure below shows both the tax rate at time 1 chosen by our original

Ramsey planner and what a new Ramsey planner would choose for its

time

tax_seq = SequentialLS(CRRAutility(), g=np.array([0.15]), π=np.ones((1, 1)))

n = 100

tax_policy = np.empty((n, 2))

τ_reset = np.empty((n, 2))

gov_debt = np.linspace(-1.5, 1, n)

for i in range(n):

tax_policy[i] = tax_seq.simulate(gov_debt[i], 0, 2)[3]

τ_reset[i] = tax_seq.simulate(gov_debt[i], 0, 1)[3]

fig, ax = plt.subplots(figsize=(10, 6))

ax.plot(gov_debt, tax_policy[:, 1], gov_debt, τ_reset, lw=2)

ax.set(xlabel='Initial Government Debt', title='Tax Rate',

xlim=(min(gov_debt), max(gov_debt)))

ax.legend((r'$\tau_1$', r'$\tau_1^R$'))

ax.grid()

fig.tight_layout()

plt.show()

The tax rates in the figure are equal for only two values of initial government debt.

45.4.5. Tax Smoothing and non-CRRA Preferences#

The complete tax smoothing for

To see what is driving this outcome, we begin by noting that the Ramsey tax rate for

For CRRA preferences, we can exploit the relations

from the first-order conditions.

This equation immediately implies that the tax rate is constant.

For other preferences, the tax rate may not be constant.

For example, let the period utility function be

We will create a new class LogUtility to represent this utility function

log_util_data = [

('β', float64),

('ψ', float64)

]

@jitclass(log_util_data)

class LogUtility:

def __init__(self,

β=0.9,

ψ=0.69):

self.β, self.ψ = β, ψ

# Utility function

def U(self, c, l):

return np.log(c) + self.ψ * np.log(l)

# Derivatives of utility function

def Uc(self, c, l):

return 1 / c

def Ucc(self, c, l):

return -c**(-2)

def Ul(self, c, l):

return self.ψ / l

def Ull(self, c, l):

return -self.ψ / l**2

def Ucl(self, c, l):

return 0

def Ulc(self, c, l):

return 0

Also, suppose that

To compute the tax rate, we will use both the sequential and recursive approaches described above.

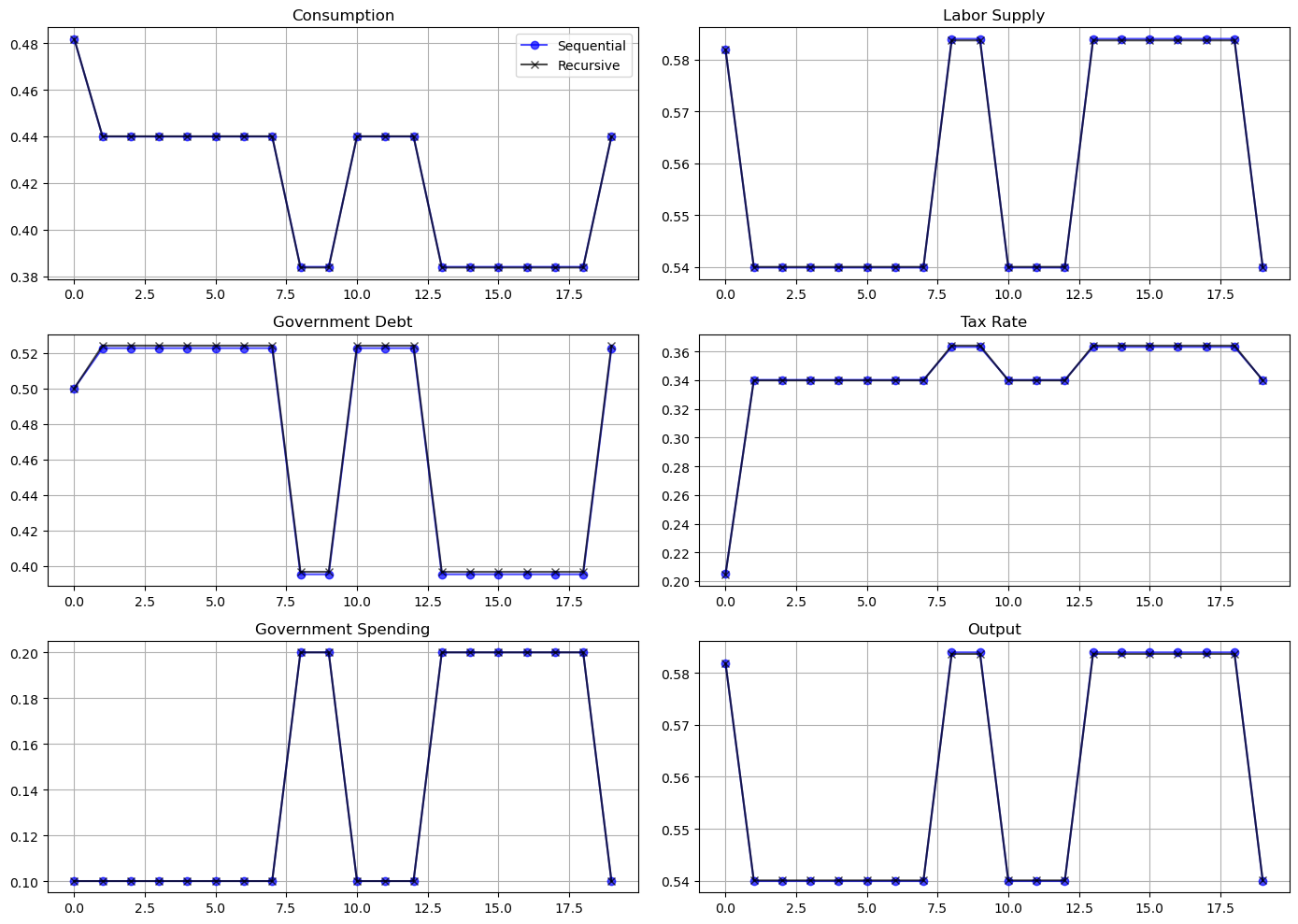

The figure below plots a sample path of the Ramsey tax rate

log_example = LogUtility()

# Solve sequential problem

seq_log = SequentialLS(log_example)

# Initialize grid for value function iteration and solve

x_grid = np.linspace(-3., 3., 200)

# Solve recursive problem

rec_log = RecursiveLS(log_example, x_grid)

T_length = 20

sHist = np.array([0, 0, 0, 0, 0,

0, 0, 0, 1, 1,

0, 0, 0, 1, 1,

1, 1, 1, 1, 0])

# Simulate

sim_seq = seq_log.simulate(0.5, 0, T_length, sHist)

sim_rec = rec_log.simulate(0.5, 0, T_length, sHist)

fig, axes = plt.subplots(3, 2, figsize=(14, 10))

titles = ['Consumption', 'Labor Supply', 'Government Debt',

'Tax Rate', 'Government Spending', 'Output']

for ax, title, sim_s, sim_b in zip(axes.flatten(), titles, sim_seq[:6], sim_rec[:6]):

ax.plot(sim_s, '-ob', sim_b, '-xk', alpha=0.7)

ax.set(title=title)

ax.grid()

axes.flatten()[0].legend(('Sequential', 'Recursive'))

fig.tight_layout()

plt.show()

As should be expected, the recursive and sequential solutions produce almost identical allocations.

Unlike outcomes with CRRA preferences, the tax rate is not perfectly smoothed.

Instead, the government raises the tax rate when

45.4.6. Further Comments#

A related lecture describes an extension of the Lucas-Stokey model by Aiyagari, Marcet, Sargent, and Seppälä (2002) [Aiyagari et al., 2002].

In the AMSS economy, only a risk-free bond is traded.

That lecture compares the recursive representation of the Lucas-Stokey model presented in this lecture with one for an AMSS economy.

By comparing these recursive formulations, we shall glean a sense in which the dimension of the state is lower in the Lucas Stokey model.

Accompanying that difference in dimension will be different dynamics of government debt.